Empowering Financial Institutions Across Africa

Streamline operations, automate workflows, and unlock real-time insights with Vitse.

Streamline operations, automate workflows, and unlock real-time insights with Vitse.

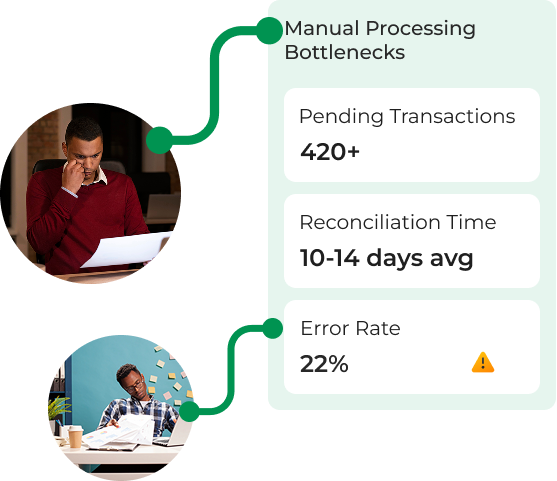

Delayed approvals and poor tracking.

Lack of tools for goal-based savings or accessible investment options.

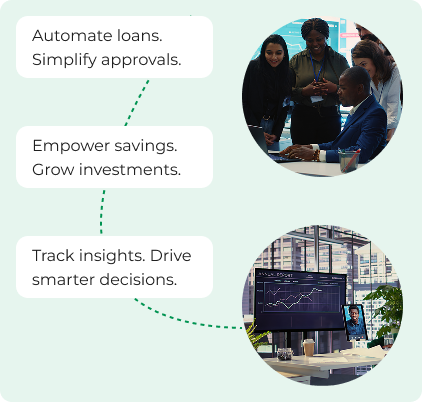

Tedious reporting processes and complex compliance requirements.

Difficulty reaching underserved and rural populations.

Streamline core financial operations with advanced tools for:

Join the movement transforming finance across Africa with Vitse.